🧩 Introduction: Thinking About the Sephora Credit Card? Read This First

A Sephora credit card review will tell you everything: the rewards program, fees, real user experiences, and your approval odds.

In this expert-recommended (and SEO-optimized) guide, we’ll cover:

- What the Sephora Credit Card will offer in 2025

- How it compares to other beauty store credit cards

- The rewards, benefits, interest rates, and fees

- Who it’s for (and who should skip it)

💡 Our Goal: Provide you with a comprehensive understanding of the Sephora Credit Card, offering clear and honest insights based on practical use cases and the latest financial updates.

I’m excited to dig into this comprehensive breakdown and help you shop (and spend) smarter.

![What Is the Sephora Credit Card [2025 Overview]](https://finverrahq.com/wp-content/uploads/2025/07/💳-What-Is-the-Sephora-Credit-Card-2025-Overview-1024x576.jpeg)

💳 What Is the Sephora Credit Card? [2025 Overview]

If you’re reading and asking yourself, “What is the Sephora Credit Card, and how does it work in 2025?” You’re not alone. There are two versions of the card provided by Sephora and Comenity Bank, offering customers the power of beauty rewards and financing their purchases in-store and at other locations.

The Sephora Credit Card comes in two main types:

| Card Type | Where You Can Use It | Main Benefits |

| Sephora Credit Card | Sephora stores + online only | 4% cashback on Sephora purchases |

| Sephora Visa Credit Card | Anywhere Visa is accepted | Sephora stores and online only |

Key differences:

- Sephora Store Card: Accepted at Sephora stores and on sephora.com. Ideal for loyal shoppers.

- Sephora Visa Card is great for: Accepted anywhere Visa is, for maximum versatility.

Both are Comenity Bank retail store credit cards. They have no annual fee and are integrated with Sephora’s Beauty Insider rewards program, so you can earn extra loyalty rewards.

📌 Quick Facts & 2025 Card Details

Here’s what to know before you apply for the Sephora Credit Card in 2025:

- Issuer: Comenity Capital Bank

- Annual Fee: $0

- APR: Variable, generally 29.99%–31.24% (based on creditworthiness)

- Rewards:

- 4% back on Sephora purchases

- Visa version earns 1% back on all other purchases

- Bonus Offer: Get 25% off your first purchase at Sephora with the card (available later in 2025)

- Needed Minimum Credit Score to Apply: Usually 620+ (fair to good credit)

🧠 Why It Matters:

Being aware of how the Sephora Credit Card works and how it compares with traditional rewards cards or other store-branded offers can enable you to decide whether it fits your spending habits, financial goals, and credit profile.

🎁 Sephora Credit Card Rewards Program: Is It Worth It?

And the question most applicants want answered:

“Is the Sephora Credit Card worth it for its rewards in 2025?”

We break down the Sephora credit card benefits, from earning cash back to receiving exclusive Beauty Insider bonuses.

💸 4% Back at Sephora: Is It a Good Deal?

When you use the Sephora Credit Card or Sephora Visa Credit Card at Sephora stores or Sephora.com, you receive 4% back with every purchase. That’s like getting 4 points per $1, a very fair deal for everyday shoppers.

Here’s how it works:

- $100 spent at Sephora = $4 in rewards

- Rewards are redeemable in $5 reward cards for every 500 points

- Points do not expire, provided that the account is in good standing and active.

🎉 Insider Extras: Birthday Gifts, Early Access & VIP Deals

With your Sephora Credit Card, you can get exclusive Beauty Insider benefits, plus:

- Birthday gifts every year

- Early access to Sephora sales and product releases

- Cardholder-only events and promotions

These benefits are particularly alluring for Beauty Insider Rouge and VIB members looking to stockpile benefits.

🌍 Sephora Visa Credit Card: Earn Outside the Store Too

If you’re approved for the Sephora Visa Credit Card, you can earn 1% cash back on all other non-Sephora purchases, from groceries or gas. That’s not as competitive as flat-rate reward cards like Chase Freedom or Capital One Quicksilver, which both offer unlimited 1.5% cash back with no strings attached. Still, it’s a nice extra incentive if you’re looking for a card that can do a little more than just hang out in your makeup bag.

Pro Tip: Use the Sephora Visa Card for Sephora shopping and a general cashback card for everything else to ensure you’re earning as much as you can.

✅ Pros of the Rewards Program

- High 4% return at Sephora

- No annual fee

- Automatic enrollment in Beauty Insider

- 25% off First order offer

- Personal sales and gifts only for subscribers

⚠️ Limitations to Consider

- If the account is closed, rewards expire

- Rewards are redeemable at Sephora only

- No introductory APR

- A 1% external rewards rate may only be competitive for non-Sephora buys

🧠 Bottom Line

If you’re a regular Sephora shopper, whether it’s online or at a store, the savings can quickly add up. The 4% cashback plus extras make it an excellent choice for beauty fans. However, if you are seeking flexible rewards or a low APR, you may want to consider alternatives.

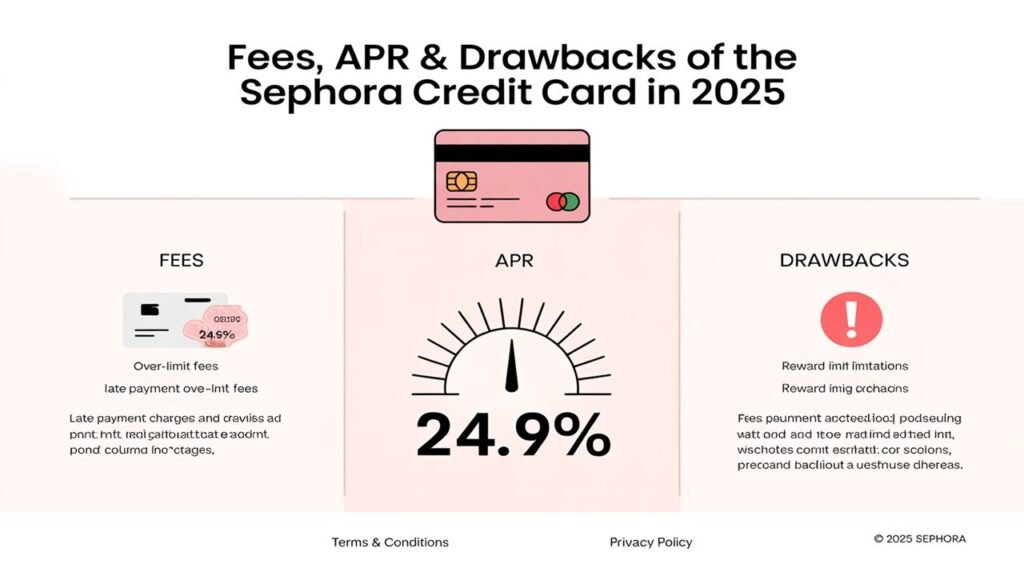

💳 Fees, APR & Drawbacks of the Sephora Credit Card in 2025

What are the hidden costs of the Sephora Credit Card?

It is very important to know the fees, interest rates, and penalties before you apply. Although the card offers some great benefits, it also has some significant financial drawbacks that you should be aware of.

🏷️ No Annual Fee: But Is It Really Free?

Neither the Sephora Store Card nor the Sephora Visa Credit Card comes with an annual fee, a big benefit for budget-conscious shoppers.

💰 Sephora Credit Card APR: What’s the Interest Rate?

This is where many people get burned.

- Regular APR: Usually around 30.24% variable (based on creditworthiness)

- No 0% intro APR on purchases or balance transfers

- You will be charged interest if you don’t pay your balance in full every month

⚠️ A high APR means a balance can make your Sephora haul a lot more costly over time.

⛔ Late Payment Fees & Penalties

Miss a payment? Be prepared to pay up:

- Late fee: Up to $41

- Returned payment fee: Up to $30

- Penalty APR: Penalty APR may apply if you make a late payment.

💡 Always do autopay or reminders, and you’ll never have any unneeded charges.

📉 Can the Sephora Credit Card Hurt Your Credit?

Yes, like any retail credit card, it can impact your credit utilization and average account age, which can affect your credit score.

Be cautious if:

- You’re trying to build credit.

- You already have high balances on other cards. If you’re using a lot of credit already, a bank won’t be eager to give you access to more.

- You could start neglecting to pay in full every month.

🚫 Drawbacks You Shouldn’t Ignore

Cons of the Sephora Credit Card: Same as the other store credit cards on the market. The $80 bonus is not offered as a cash reward.

- High APR relative to other general-purpose credit cards

- Limited use (store only at Sephora)

- No intro offers, such as 0% APR or signup bonus

- Rewards redemption restricted to Sephora

- May encourage overspending on beauty products

🧠 Bottom Line

The Sephora Credit Card is look glamorous, but it has real financial implications if misused. It’s ideal for dedicated Sephora shoppers who pay in full every month. If you normally carry a balance, a low-interest credit card may work better for you.

📝 How to Apply for the Sephora Credit Card Requirements & Approval Tips:

✅ How and Where to Apply for the Sephora Credit Card?

There are two ways to apply for a Sephora Credit Card:

- Online at the Sephora credit card website

- In-store at Sephora and Sephora.com

The application is fast, and Comenity Capital Bank, the card issuer, makes decisions quickly.

📊 What Credit Score Do You Need?

If you’re applying for the version you are applying for:

- Sephora Store Card: Fair to Good (580–670+)

- Sephora Visa Card: Good to Excellent (670–750+)

💡 Tip: The Visa version is more difficult to qualify for, but you’ll have greater flexibility and higher rewards.

📋 Application Requirements

To apply, you’ll typically need:

- A valid U.S. government-issued ID

- Your Social Security Number

- A U.S. mailing address

- Your annual income

🧾 When you apply for the card, Comenity will perform a hard credit check, which can cause your credit score to decrease by a few points in the short term.

💬 Can You Get Instant Approval?

Yes, many applicants receive an immediate decision. But some may end up in manual review, especially if:

- Your credit file is thin

- Your reported income is inconsistent

- You have new delinquencies on your report

🛑 What If You’re Denied?

If it is denied, you’ll get a letter called an adverse action letter telling you why. Common reasons include:

- Low credit score

- High existing debt

- Limited credit history

✅ Pro Tip: Wait at least 90 days before reapplying, and try to raise your credit score before doing so.

![How the Sephora Credit Card Works [Explained with Examples]](https://finverrahq.com/wp-content/uploads/2025/07/How-the-Sephora-Credit-Card-Works-Explained-with-Examples-1024x576.jpeg)

🧾 How the Sephora Credit Card Works [Explained with Examples]

🛒 How Can You Use the Sephora Credit Card?

There are two iterations of the card:

- Sephora Credit Card (Store-only):

- Redeemable only in Sephora stores and Sephora.com

- Ideal for loyal Sephora shoppers

- Sephora Visa Credit Card:

- Accepted anywhere Visa is accepted

- Provides more use and even more bonus categories

💳 When Do You Start Earning Rewards?

- You’ll also begin accruing Beauty Insider points as soon as the card is activated.

- For every eligible dollar spent:

- 4% back in points at Sephora (on the card)

- 2X points for Beauty Insider members Get more!

- Points will appear in your Sephora account 24–48 hours later.

📆 How Is the Billing Cycle Structured?

- Bill due date with minimum due per month

- You can manage payments via:

- Sephora Credit Card Account Center

- Comenity’s mobile app

- AutoPay enrollment to help you prevent missed payments

🕐 Grace Period: Approximately 25 days after the close of each billing cycle to pay your balance without being charged interest.

📈 Can the Sephora Credit Card Help Build Credit?

Yes, if used responsibly.

- Report to one of the major credit bureaus (Experian, Equifax, TransUnion)

- But paying on time can help your credit, too, over the long term

- Higher use or slow payments could damage your score

✅ Key tip: You should work to keep your credit utilization below 30% of your credit limit to maintain a good score.

🧾 Real-Life Example

For example, if you spend $200 at Sephora with your Sephora Visa:

- You receive 4% back = 8 points per $1 → 800 points

- And 2X Beauty Insider points

- That’s $10+ in savings possible to save for your future purchases

💎 Sephora Credit Card Rewards & Benefits in 2025 [What’s New?]

🎁 What Rewards Do You Get with the Sephora Credit Card?

Whether you have the store card or the Visa version, this is what you can look forward to:

- 🔸 Sephora Store Credit Card:

- 4% back in Beauty Insider points per dollar on Sephora purchases

- Exclusive cardmember offers & events

- Early access to Sephora promotions

- 🔸 Sephora Visa Credit Card:

- 4% back at Sephora

- 1% back on everything else

- 2X Beauty Insider points as a Sephora loyalty member.

- Special Discounts on Visas and exclusive Cashback for a limited time

🔄 How Are Points Calculated?

- 1$ on Spent at sephora= 4 points

- 100 points = $1 in rewards

- Can be redeemed for:

- Discounts at checkout

- Free samples

- Insider-exclusive beauty sets

Example: Spend $250 at Sephora = 1,000 points = $10 in rewards

📅 What’s New in 2025?

Sephora Credit Card Benefits Enhanced:

- Birthday bonus points (new!)

- New Categories for Visa cashback (beauty spas, wellness clinics)

- Double Points Weekends added quarterly

- Quicker point posting (24 hours now)

🔐 Exclusive Cardmember Benefits

- Early access to seasonal sales

- Private shopping experiences (available in stores)

- No annual fee

- Fraud protection: In case of loss, theft or defective usefulness of the card and mobile wallet acceptability.

💡Pro Tip: Use the Sephora Visa card to earn external rewards on wellness or salon purchases.

![Sephora Credit Card Interest Rates, Fees & Hidden Costs [What You Need to Know]](https://finverrahq.com/wp-content/uploads/2025/07/Sephora-Credit-Card-Interest-Rates-Fees-Hidden-Costs-What-You-Need-to-Know-1024x576.jpeg)

💳 Sephora Credit Card Interest Rates, Fees & Hidden Costs [What You Need to Know]

📈 What is the APR on the Sephora Credit Card?

- Purchase APR:

- Store Card: 33.24% (variable)

- Visa Card: 30.24%–33.24% (variable)

- Penalty APR: None, but may apply after missed payments — up to 35.99%

🔎Note: These are much higher than traditional credit cards — it doesn’t take many months of carrying a balance for your rewards to be wiped out.

💰 Are There Any Annual Fees?

- $0 annual fee on both versions of the card

- ✅ This makes it more accessible for occasional shoppers.

💸 Other Fees to Be Aware Of:

| Fee Type | Amount |

| Late Payment Fee | Up to $41 |

| Returned Payment Fee | Up to $30 |

| Cash Advance Fee | 5% (Visa version only) |

| Foreign Transaction Fee | 3% (Visa version only) |

⚠️ Hidden Costs You Can’t Afford to Ignore

- Interest is charged from the purchase date if you don’t pay in full monthly.

- Rewards can be time sensitive if the account is not used.

- Deferred interest may be charged on promotional financing. Be sure to read the fine print!

💡 Expert tip: Never let a balance carry over to the next month. Given their high APRs, your rewards can easily be swallowed up.

🧍♀️ Who Should Apply for the Sephora Credit Card in 2025? [Is It Right for You?]

✅ Best for These Types of Shoppers

If you’re in any of the categories below, this card might make sense to keep in your wallet:

- Frequent Sephora Shoppers: Get 4% back on all Sephora purchases (in addition to Beauty Insider points).

- Beauty Insider Members: Combine rewards with your Insider tier for double the kickback.

- Loyal Sephora Visa Cardholders: Earn 1% back on non-Sephora purchases with the Visa version, ideal for everyday use.

- Budget-conscious users: No annual fee means you can keep the card without long-term cost.

⚠️ Not Ideal For…

If you are, here are several reasons why you might want to reconsider before you hit apply:

- Carry a balance regularly: This card is expensive if you don’t pay in full – the APR is high at 30% or more.

- Don’t shop at Sephora often: Rewards are limited outside Sephora unless you have the Visa version.

- Have a low credit score: May not be eligible — and this card isn’t worth it unless you can get approved for the Visa version.

🧠 Finance Pro Tip

If you love Sephora and always pay your balance in full, this card delivers real value.

But if you’re chasing flexible rewards or plan to carry a balance, look elsewhere.

![How to Apply for the Sephora Credit Card in 2025 [Step-by-Step Guide]](https://finverrahq.com/wp-content/uploads/2025/07/How-to-Apply-for-the-Sephora-Credit-Card-in-2025-Step-by-Step-Guide-1024x576.jpeg)

📝 How to Apply for the Sephora Credit Card in 2025 [Step-by-Step Guide]

🔍 Where Can You Apply?

You can apply:

- Where can I pay at Sephora.com/credit (COMENITY)?

- In-store at checkout

- Through Sephora’s mobile app (discounts for a limited time!)

💡 Filling out an application online is also the fastest and most transparent way to view offers and terms.

✅ Sephora Credit Card Requirements

Before you apply, ensure you meet these fundamental requirements:

- (some states 19+) Must be 18+

- Valid U.S. government-issued ID

- U.S. mailing address

- Good to excellent (usually 660+)

📋 Information You’ll Need to Provide

Have the following ready:

- Complete legal name and date of birth.

- Social Security Number (credit check only)

- Annual income estimate

- Employment status

- Contact details (phone, email, address)

📉 Will Applying Hurt Your Credit?

Yes: you will get a hard inquiry on your credit report.

If approved, the new card account may help you build your credit history over time (with responsible use).

🧠 Smart Tips Before You Apply

- Beforehand, check your credit score on platforms such as Credit Karma or Experian.

- Use during bonus events — Sephora regularly offers first-use bonuses.

- Choose the Visa version if you plan to use the card for rewards outside Sephora.

🔄 Sephora Credit Card vs. Other Retail Credit Cards: How Does It Compare?

🛍️ Sephora Credit Card vs. Ulta Beauty Credit Card

| Feature | Sephora Credit Card | Ulta Beauty Credit Card |

| Rewards at Store | 4% back in Sephora Credit Card Rewards | 5% back in Ultamate Rewards |

| Welcome Bonus | 25% off first purchase | 20% off first purchase |

| Usable Outside Store? | Yes (Visa version only) | Yes (Mastercard version only) |

| Exclusive Perks | Sephora Beauty Insider integration | Birthday gifts, salon discounts |

Winner: Ulta offers slightly better in-store rewards, but Sephora edges ahead with broader Visa usability.

💳 Sephora Card vs. Target RedCard

| Feature | Sephora | Target RedCard |

| In-store Rewards | 4% | 5% at Target |

| Annual Fee | $0 | $0 |

| Usability | Visa version usable anywhere | Target only |

| Added Perks | Beauty Insider points, promo offers | Free shipping, extended returns |

Winner: If you shop often at Target, the RedCard is unbeatable. For beauty lovers, Sephora is more specialized.

🏆 When Does Sephora Win?

- You’re someone who always visits Sephora, whether online or in-store.

- You’re looking to cash in and earn Beauty Insider points

- You want a card that functions elsewhere (Visa version)

✅ Final Thoughts: Is The Sephora Credit Card Worth It In 2025?

Is the Sephora Credit Card worth it for beauty families in 2025? That will depend on your shopping habits and financial goals.

🎯 Get It If You:

- Frequent Sephora (in-store and online) shopper

- Trying to spend maximum on Beauty Insider

- Can use the Visa version for everyday spending

- Budget to pay your balance in full every month (carrying a balance is expensive with a high APR)

🚫 Skip It If You:

- Rarely shop at Sephora.

- Want flexible rewards or cashback?

- Already have a rewards card with higher rates in several categories.

- Also tends to revolve around a balance each month.

🔍 Final Take:

The Sephora Credit Card is a decent niche card for anyone who loves Sephora. It has a big, juicy first-purchase discount, dovetails neatly into the Beauty Insider program…and can take its place in your wallet as a general-use Visa card, should you qualify. But as with all store cards, it’s easiest to use it to your advantage if you use it strategically and responsibly.

❓ Frequently Asked Questions (FAQ) About Sephora Credit Card

1. What credit score do I need for the Sephora Credit Card?

To qualify, you’ll generally need a credit score of 660 or above. Sephora is serviced by Comenity Bank and will likely approve applicants with fair to good credit.

2. Does the Sephora Credit Card have an annual fee?

The Sephora Store Card and Sephora Visa Credit Card do not have an annual fee.

3. Can I use my Sephora Credit Card anywhere?

The Sephora Visa account can be used everywhere Visa credit cards are accepted. The Sephora Store Card is a closed-loop credit card that can only be used at Sephora stores and Sephora.com.

4. Do Sephora Credit Card purchases earn Beauty Insider points?

Yes! You build Beauty Insider points on Sephora purchases. With the Visa version, you can also earn points on non-Sephora purchases.

5. How do I pay my Sephora Credit Card bill?

You can make payments online from your Comenity Bank account, over the phone, or through the mail. There is also an option for AutoPay.

Pingback: Victoria Secret Credit Card | Best Guide 2025

Pingback: Corpay Business Credit Card | Best Review 2025 Is It Worth?

Pingback: Why IUL Is a Bad Investment in 2025 | Best Guideline